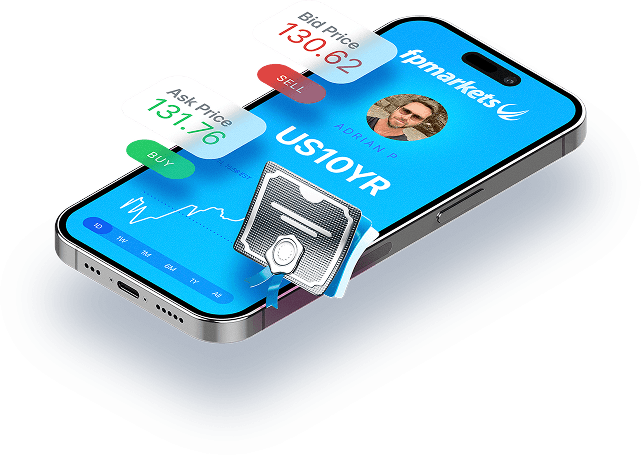

Investors purchase government or corporation bonds as part of their diversification strategy. Traders can do the same with Bond CFDs as these derivatives track the price movements of the underlying asset.

Trading CFDs on Bonds gives traders exposure to global fixed income markets without the need to own bonds themselves. They can speculate on price fluctuations in both directions and find short-term trading opportunities. Bond CFDs are also used to hedge against interest rate movements thanks to their inverse relationship.

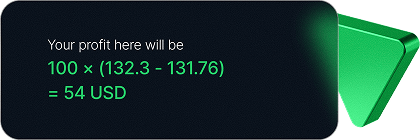

As with all CFDs, high leverage and low margin help traders build their portfolios with less capital when compared to investing in actual bonds.